DECREE NO. 236/2025/NĐ-CP GUIDING THE IMPLEMENTATION OF RESOLUTION NO. 107/2023/QH15 ON THE APPLICATION OF SUPPLEMENTARY CORPORATE INCOME TAX UNDER THE GLOBAL ANTI-BASE EROSION RULES.

On August 29, 2025, the Government issued Decree No. 236/2025/NĐ-CP, detailing certain provisions of Resolution No. 107/2023/QH15 dated November 29, 2023, of the National Assembly regarding the application of supplementary corporate income tax under the global anti-base erosion (GloBE) rules.

This Decree establishes the legal framework for implementing the OECD’s GloBE rules in Vietnam, including:

- Qualified Domestic Minimum Top-up Tax (QDMTT): Applicable to constituent entities of foreign multinational enterprise (MNE) groups operating in Vietnam.

- Income Inclusion Rule (IIR): Applicable to Vietnamese multinational enterprise groups and their foreign constituent entities.

The decree takes effect from October 15, 2025, allowing multinational corporations to prepare for their first supplementary tax filing for the 2024 fiscal year. Details are as follows:

1. Specific regulations for global minimum tax payers.

- Applicable to Multinational Enterprises (MNEs) with consolidated revenue of at least EUR 750 million in at least 2 of the 4 preceding fiscal years

- For newly established MNEs, if they have operated for less than 4 years but achieved the above revenue threshold in at least 2 years, their constituent entities will also be considered as tax payers.

However, not all cases fall under the scope of application. Decree No. 236/2025/NĐ-CP also clearly defines the groups of entities that are excluded. These include those mentioned in Resolution No. 107/2023/QH15 and its accompanying annexes, such as investment funds, real estate investment organizations, or certain entities with specific ownership structures and operational characteristics.

2. Cases eligible for Relief from Liability

The Decree introduces additional provisions on Relief from Liability beyond those outlined in Resolution No. 107/2023/QH15, aiming to reduce unnecessary compliance and administrative burdens for multinational enterprises and tax authorities. These measures will allow an MNE to avoid calculating the effective tax rate and Qualified Domestic Minimum Top-up Tax (QDMTT) for activities likely to be taxed at or above the minimum tax rate, thereby enhancing tax certainty and transparency.

2.1 Relief from Liability during the initial phase of new international investment activities.

- The supplementary tax under the QDMTT in Vietnam is determined to be zero (0) during the initial phase of a multinational enterprise’s international investment activities.

➞ This provision gives multinational enterprises in the early stages of international investment additional time to prepare for the impact of the GloBE rules.

- A multinational enterprise is considered to be in the initial phase of international operations if it simultaneously meets both of the following conditions in the fiscal year used to determine its tax liability:

✔ The multinational enterprise has constituent entities in no more than six countries at any point during the fiscal year used to determine tax liability.

✔ The total book value of tangible assets held by all constituent entities in all countries other than the reference country does not exceed EUR 50 million.

** Note:

- The book value of tangible assets is calculated as the average of the opening and closing balances of tangible assets recorded in the financial statements of each constituent entity, after deducting accumulated depreciation or amortization and impairment losses.

- The reference country of a multinational enterprise is the country where the enterprise holds the highest total value of tangible assets in the first fiscal year in which it becomes subject to the global minimum tax regulations

2.2 Relief from Liability for Entities that Have Implemented QDMTT (New)

- If the QDMTT in a given country meets the conditions for Relief from Liability and has been implemented in accordance with the list published by the Inclusive Framework on Base Erosion and Profit Shifting (BEPS), the supplementary tax in that country, as stipulated in Article 7 of this Decree in Vietnam, shall be determined as zero (0).

- If the QDMTT in a given country meets the conditions for Relief from Liability but the multinational enterprise is not subject to QDMTT in that country, or the tax authority in that country does not collect QDMTT from the constituent entity located there, then the multinational enterprise shall not be eligible for the above provision in Vietnam.

➞ Relief from Liability for entities that have implemented QDMTT is designed as a practical solution to prevent cases where multinational enterprises would otherwise have to repeatedly calculate supplementary tax for the same group of constituent entities in a given country.

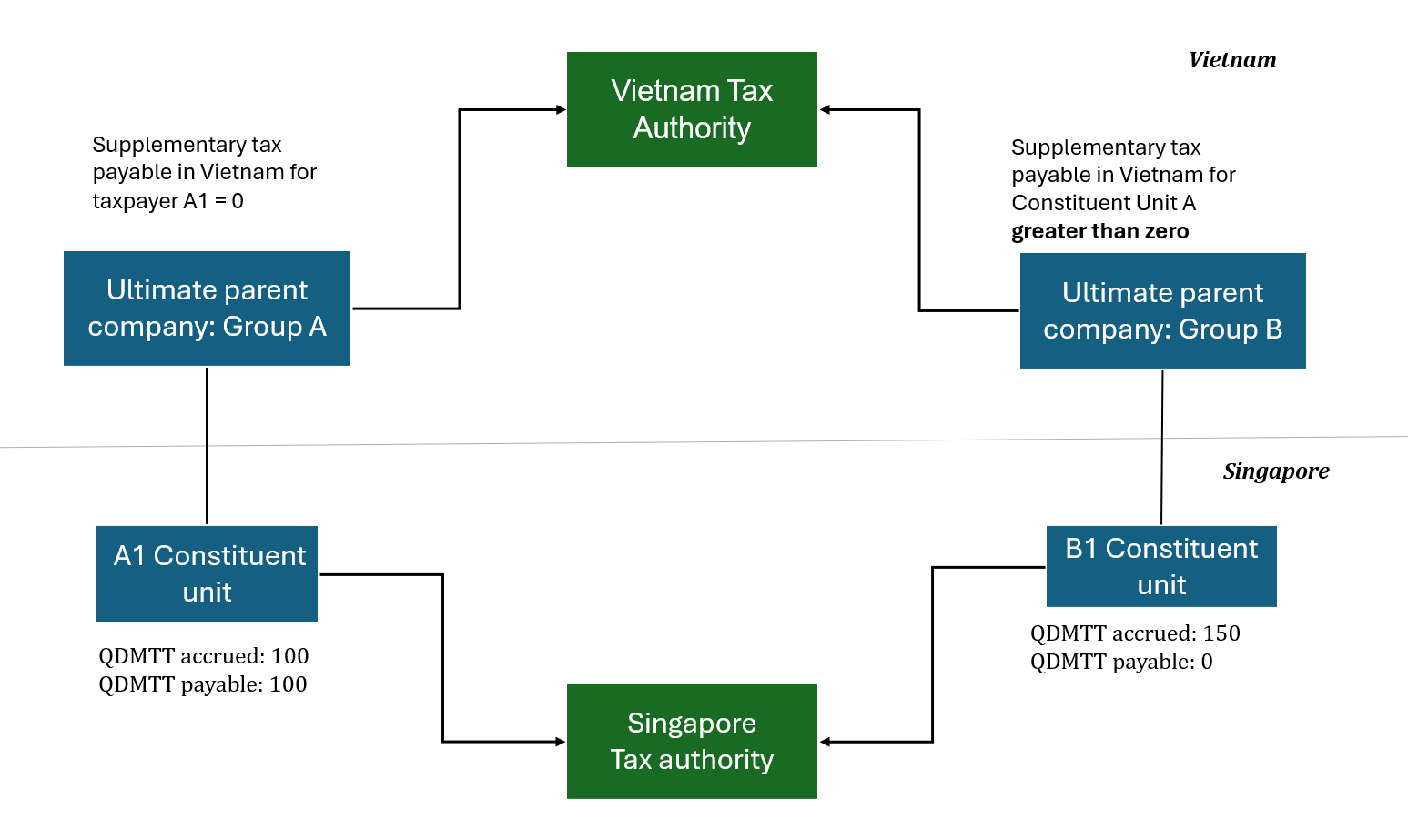

Example:

Situation:

- Singapore meets the conditions for Relief from Liability due to having implemented QDMTT.

- Group A has a constituent entity A1 in Singapore, with a QDMTT amount of 100 arising in Singapore.

- Group B has a constituent entity B1 in Singapore, with a QDMTT amount of 150 arising in Singapore. However, due to commitments with the Singapore Government, the Singapore tax authority did not collect this tax.

Diagram:

2.3 Relief from Liability during the transitional period based on the Country-by-Country Report (as amended and guided by Article 11 of Decree No. 236/2025/NĐ-CP)

- Applicable to fiscal years beginning on or before December 31, 2026 (excluding fiscal years ending after June 30, 2028).

- The top-up tax payable under the QDMTT or IIR provisions shall be zero (0) if

✔ Revenue is less than EUR 10 million and profit before corporate income tax is less than EUR 1 million, or there is a loss in that country; or

✔ The simplified effective tax rate in that country is equal to or greater than 15% (FY2024), 16% (FY2025), or 17% (FY2026); or

✔ Profit before tax is less than or equal to the exclusion threshold based on income derived from substantive economic activities;

✔ A loss is reported in a qualifying Country-by-Country Report.

** Note:

- Total revenue and profit before corporate income tax must be derived from a qualifying Country-by-Country Report (CbCR).

- The Decree also provides guidance on qualifying CbCRs, qualifying financial statements, and the application of Relief from Liability based on CbCRs for Ultimate Parent Entities and their subsidiaries.

- The “Once Out, Always Out” rule: If a multinational enterprise does not apply the transitional Relief from Liability provisions in the preceding fiscal year, it will not be eligible to apply CbCR-based Relief from Liability in the following year.

- Exemption from administrative penalties during the transitional period for the following violations:

✔ Late or non-submission of the notification designating the constituent entity responsible for filing and the list of constituent entities

✔ Late tax registration (up to 90 days after the deadline)

✔ Late notification of changes to tax registration information

✔ Incomplete or erroneous documentation that does not result in a shortfall of tax payable

✔ Late submission of tax returns in certain cases

✔ Incorrect declarations leading to a shortfall of tax payable in certain cases

2.4 Relief from Liability (New)

- The top-up tax in a country (excluding the adjusted top-up tax for the current year) for the fiscal year shall be determined as zero (0) if one of the following criteria is met:

✔ Normal profit test; or

✔ Threshold test for minimum revenue and income; or

✔ Effective tax rate test

- A constituent entity may elect to use a simplified calculation method to determine whether it meets the above criteria, except for the simplified calculation method prescribed for non-material constituent entities.

➞ The Decree has not yet provided detailed guidance on the simplified calculation method for determining whether these criteria are met for other constituent entities.

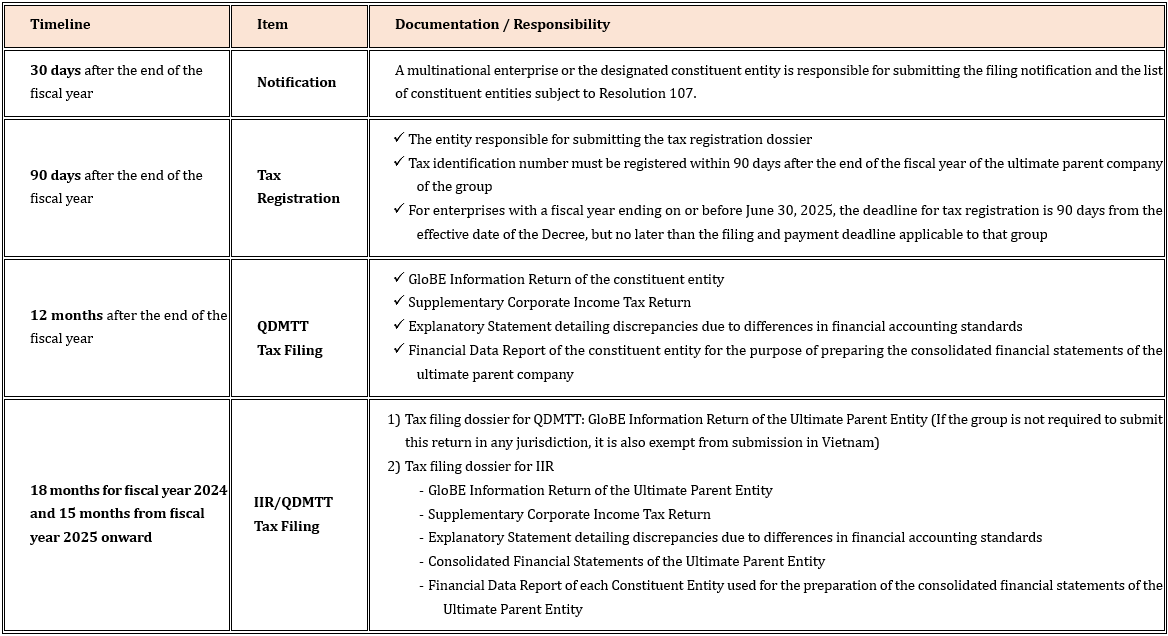

3. Administrative Obligations

Entity responsible for tax registration:

- Constituent entity designated to file on behalf of a multinational enterprise group

- Joint venture not considered a member of the joint venture group

- Company designated to file on behalf of the joint venture group

- Constituent entity designated to file on behalf of a sub-group whose ultimate parent entity is a minority owner

- Constituent entity whose ultimate parent entity is a minority owner and is not a member of the sub-group whose ultimate parent entity is a minority owner

Accounting Standards & Currency for Tax Filing and Payment

- The financial statements of constituent entities prepared in accordance with the financial accounting standards used for the consolidated financial statements of the ultimate parent entity shall be applied. Other financial accounting standards may be used under specific circumstances and conditions.

- The consolidated reporting currency of the ultimate parent entity shall be used to calculate the top-up tax. Enterprises may pay in this currency or in Vietnamese đồng (VND), converted at the average exchange rate on the tax filing date.

- The supplementary corporate income tax under the global minimum tax regime shall be paid into the central government budget.

4. Special Rules Applicable to Joint Ventures & Constituent Entities Whose Ultimate Parent Entity Is a Minority Owner

- The effective tax rate and top-up tax obligations of joint ventures, subsidiaries of joint ventures, and constituent entities whose ultimate parent entity is a minority owner shall be calculated independently from the other constituent entities of the multinational enterprise group.

- Taxpayers falling under this category are required to prepare and submit separate notifications, tax registration dossiers, and annual tax filing documents.