OFFICIAL LETTER NO. 1105/CT-CS FROM THE TAX DEPARTMENT REGARDING TAX POLICY ON BROKERAGE COMMISSION EXPENSES

On May 9, 2025, the Tax Department issued Official Letter No. 1105/CT-CS regarding tax policy on brokerage commission expenses. Accordingly, the Tax Department stated the following position:

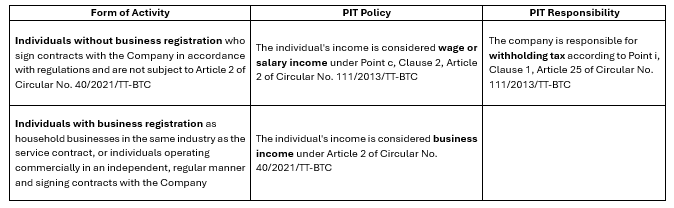

a/ Personal Income Tax (PIT) Policy

b/ Corporate Income Tax (CIT) Policy

- In cases where the company incurs brokerage commission expenses, such expenses:

- Thực tế phát sinh liên quan đến hoạt động sản xuất, kinh doanh của doanh nghiệp;

- Có đủ hoá đơn, chứng từ hợp pháp theo quy định của pháp luật;

- Nếu có hoá đơn mua hàng hoá, dịch vụ từng lần có giá trị từ 20 triệu đồng trở lên (giá đã bao gồm thuế GTGT) khi thanh toán phải có chứng từ thanh toán không dùng tiền mặt;

- Are actually incurred and related to the company’s business and production activities;

- Are supported by lawful invoices and documents in accordance with legal regulations;

- For purchases of goods or services with invoices valued at 20 million VND or more (including VAT), must be settled via non-cash payment methods;

- Will be considered deductible expenses when calculating CIT.

↪ For cases where foreign organizations or individuals provide brokerage services (for goods sales or service provision) to Vietnamese entities, but perform the services abroad:

↪ Not subject to withholding tax, pursuant to Clause 4, Article 2 of Circular No. 103/2014/TT-BTC.