KEY UPDATES IN CIRCULAR NO. 31/2025/TT-BTC GUIDING THE PRINTING, ISSUANCE, MANAGEMENT, AND USE OF ELECTRONIC STAMPS FOR ALCOHOL AND TOBACCO PRODUCTS

On May 31, 2025, the Ministry of Finance issued Circular No. 31/2025/TT-BTC, amending and supplementing several provisions of Circular No. 23/2021/TT-BTC, which provides guidance on the printing, issuance, management, and use of electronic stamps for alcohol and tobacco products. This Circular takes effect from June 1, 2025. Some notable new updates include the following:

1/ The tax administration procedures information system will automatically issue notifications for forms 04/TEM and 07/TEM.

2/ Organizations and individuals are required to report and notify the tax authority via the tax administration procedures information system regarding electronic tobacco and alcohol stamps that are no longer valid due to loss, fire, or damage. Accordingly, the tax authority will no longer issue a separate notice on this matter.

3/ Elimination of documents and papers previously required to be submitted by organizations and individuals when going to the tax authority to purchase or receive electronic tobacco and alcohol stamps.

4/ When organizations or individuals transfer stamps to the production department, they must:

- Scan the QR code affixed to the stamp box, stamp block, or individual stamp

- Enter data such as: product name, production time, unit of measurement, product selling price, etc.

5.1/ Tobacco product manufacturers or organizations and individuals producing alcohol who cease production, dissolve, declare bankruptcy, or merge must:

- Finalize and cancel remaining purchased electronic stamps within 5 working days from the date of notification of production cessation or the date of the dissolution, bankruptcy, or merger decision

- Submit a cancellation report using Form No. 04/TEM, Appendix 3 issued under Circular No. 31/2025/TT-BTC to the Tax Authority

5.2/ In the event of a split, merger, or change in tax authority management:

- If the organization or individual wishes to continue using the remaining stamps and retains a valid electronic transaction account issued by the tax authority, they must register to transfer the remaining stamp inventory under the name and tax code of the post-restructured entity using Form No. 06/TEM, Appendix 3 attached to this Circular

- If they do not wish to continue using them, they must carry out stamp reconciliation and cancellation as mentioned above

6/ Handling damaged electronic stamps for tobacco and alcohol products

- In cases where electronic stamps are damaged in storage or during the production process → Electronic stamps must be canceled (except in cases where the stamps are physically unrecognizable, in which case cancellation is not required)

- In cases where the stamps have been affixed to products and reported as used, but later become damaged during circulation or the products are destroyed due to being unusable → The electronic stamps must be canceled

Organizations and individuals must notify the tax authority of the stamp cancellation results no later than 5 working days from the date the damaged stamps are canceled, using Form No. 04/TEM, Appendix 3 issued with this Circular.

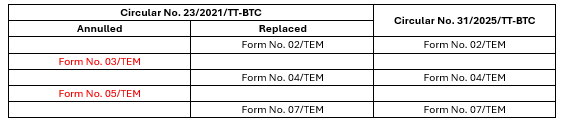

7/ Replacement and annulment of forms under Circular No. 23/2021/TT-BTC